One team for all your Tax & Regulatory needs

Leave the tax stress to us—our expert team handles your compliance, planning, and strategies, so you can focus on growth with confidence all year round.

One team for all your Tax & Regulatory needs

Leave the tax stress to us—our expert team handles your compliance, planning, and strategies, so you can focus on growth with confidence all year round.

At Grandworth, we offer comprehensive tax solutions backed by global expertise, supporting businesses of every size and individuals worldwide. Whether you’re launching a new venture, navigating tax penalties, handling registrations, or racing to meet deadlines, our experienced team ensures you stay on track with ease.

Our diverse team—CAs, ACCAs, CPAs, corporate consultants, financial advisors, and cloud software specialists—brings together decades of knowledge and innovative strategies. Serving clients across the US, UK, Canada, Australia, UAE, KSA and beyond, we’re dedicated to providing accurate, timely solutions that keep you compliant and ahead in today’s fast-paced world. Trust Grandworth to manage your taxes, so you can focus on what truly drives your success.

Taxation Services.

What do we provide?

Countries We Cater.

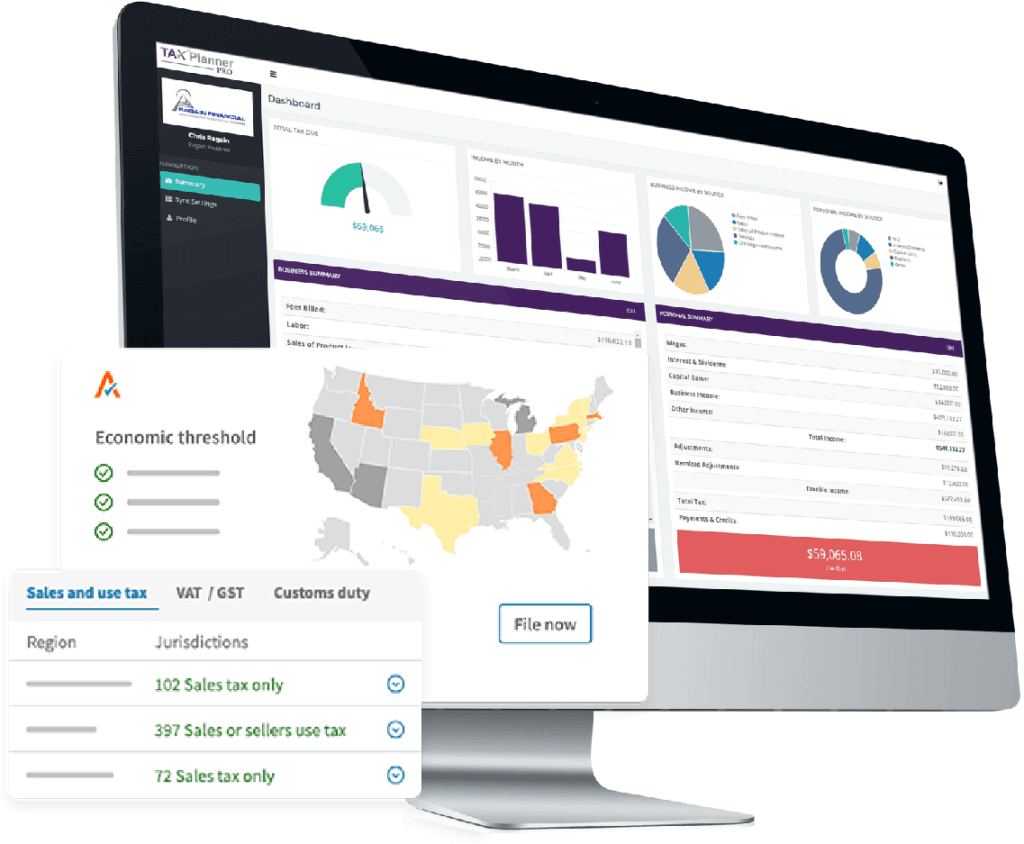

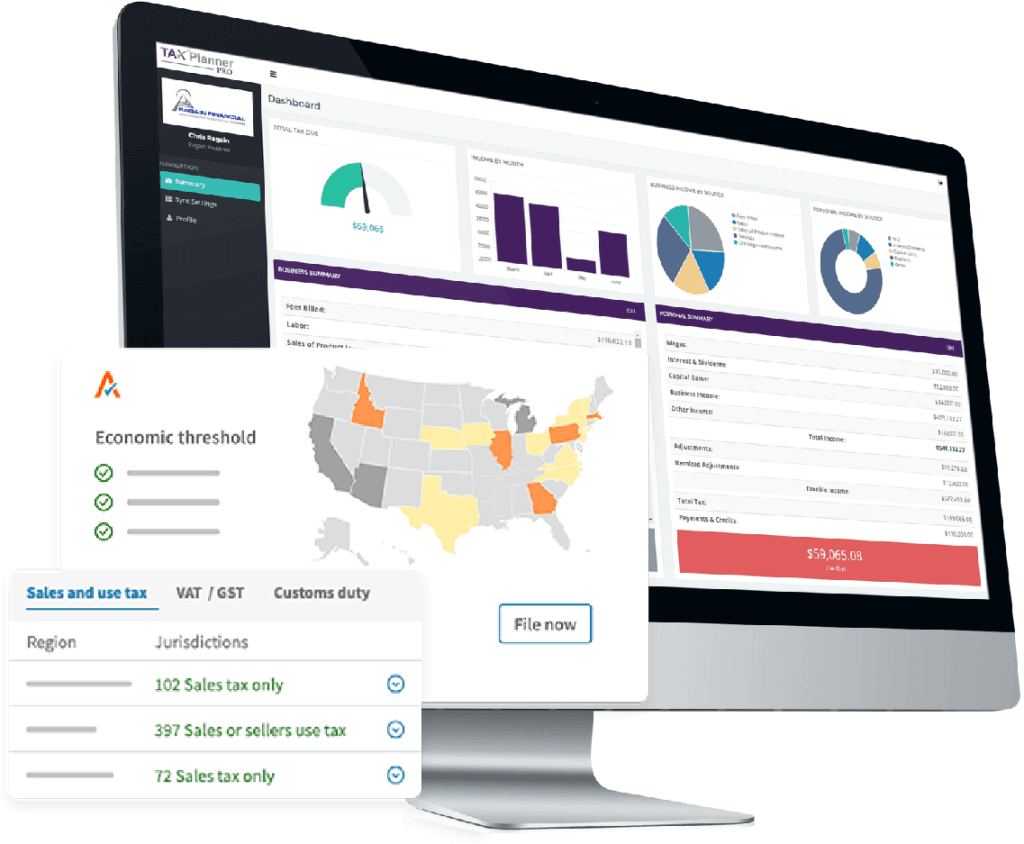

USA Taxation Services

We offer expert tax services for businesses and individuals in the US, ensuring compliance with federal, state, and local tax laws. Our goal is to minimize tax liabilities while maximizing deductions and credits.

UK Taxation Services

We provide comprehensive tax solutions for individuals and businesses in the UK, ensuring compliance with HMRC regulations. Our services help optimize tax efficiency while navigating local tax laws.

Canadian Taxation Services

Our services cover all aspects of Canadian tax compliance for individuals and businesses. We help you navigate federal and provincial tax regulations to maximize savings and ensure full compliance.

Australian Taxation Services

We offer expert tax services for individuals and businesses in Australia, ensuring compliance with ATO regulations while optimizing tax benefits and minimizing liabilities.

European Tax Services

We provide streamlined tax registration services across EU member states, ensuring your business meets all local tax requirements efficiently while minimizing administrative burdens.

UAE Taxation Services

Our services encompass major facets of UAE tax compliance for individual and businesses. We assist you in navigating federal and local tax regulations to optimize savings and ensure full compliance with the UAE Federal Tax Authority's requirements.

Saudi Arabian Taxation Services

We provide expert tax services for businesses and individuals in Saudi Arabia, ensuring compliance with local laws and regulations. Our aim is to assist clients in managing their tax responsibilities effectively while maximizing available benefits.

Taxation Services For Other Countries

We provide comprehensive tax services for businesses and individuals globally, offering guidance on common tax requirements like income tax, VAT/GST, customs duties, and withholding taxes. Our experienced team is well-versed in international tax laws, ensuring compliance while optimizing tax benefits across multiple jurisdictions. Whether you’re navigating corporate tax, personal tax, or other complex tax structures, we tailor our services to meet your unique needs.

Reach out to us today to discuss how we can support your specific requirements and explore how we can provide the expertise you need in your country.

Our Process.

Our devoted team deeply grasps your business, its roots, products, and services & creates a strong base for data flow for seamless execution.

We connect with you regularly and eliminate concerns and constraints to deliver results on time.

Regular updates, strategic insights, and continuous improvement based on feedback.

Creating invoices used to be a chore until we found GrandWorth’s invoice creation service. Now, our invoices are timely and professional. Impressive work!

Outstanding accounting services! GW team expertly handled our books, ensuring our finances are well-organized. Their professionalism shines through. Highly recommend!

Partnering with GrandWorth has been a significant asset to our organization. Their team’s dedication and outstanding services have greatly benefited us. They are consistently accommodating and a pleasure to collaborate with.

I would like to extend my gratitude and congratulations to the GW team for their exceptional support and cooperation. The experience during the assignment was truly remarkable.

Your team demonstrates a high level of professionalism, with deep expertise in tax and regulatory matters. Their courteous approach makes our collaboration highly valuable. We are fortunate to have established this relationship.

FAQs

Tax planning involves strategically organizing your financial affairs to minimize your tax liability. Our experts can help you identify opportunities to reduce your tax burden and optimize your financial position.

We specialize in providing tailored tax solutions for all business sizes including small businesses, LLPs, and corporations across multiple industries. Our services include tax return preparation, bookkeeping, compliance, and more to help your business thrive.

We prioritize the protection of your sensitive financial information. Our robust security measures ensure that your data is handled with the utmost confidentiality and integrity.

Tax Preparation Outsourcing yields your firm tremendous outcomes in the short and long run. Outsourcing Taxation works helps you stay compliant with federal and state tax laws and legislation. You will get your tax reports prepared by veteran tax specialists.

You can concentrate on your other business activities while your tax filing is being handled and delivered with 100% accuracy within the deadline. It helps you achieve scalability without deploying capital on upgrading infrastructure, training human resources, and upgrading software.

Outsourcing tax preparation has several benefits, such as enhancing your internal team productivity, cashing in more projects, and focusing on high-margin revenue generation activities. The following are the salient benefits:

Offshore refers to a destination/city in another country where tax laws and regulations differ from the home country.

Multitudinous businesses are taking advantage of Offshore Tax Haven, which involves shifting your business operations, such as accounting, bookkeeping, tax, and payroll activities, to a country where they can enjoy benefits, such as tax avoidance, minimal or no tax liability for their deposits, politically and economically stable environment, and relaxed regulations.

Companies widely adopt it to enjoy tax-favorable business conditions to maximize their net profits.

We recommend considering the following workflow and elements for outsourcing income tax preparation:

By following the above steps, you can successfully outsource income tax preparation.

Many CPA and Accounting Firms outsource Tax Preparation Services to take advantage of minimizing tax liabilities. Offshore Tax Consultants are well-versed in techniques and have extensive knowledge to reduce tax liabilities by identifying credits and deductions and reviewing implemented strategies for optimizing current tax position, resulting in significant savings.

Tax Preparation Outsourcing involves hiring a third-party service provider and assigning them the tasks of preparing tax forms, filing returns statements, and related reports in compliance with state laws and regulations and using best practices.

Tax Preparation Outsourcing Services include reviewing prior accounting years’ returns, tracking all credit and debit entries, assessing all deductions, applying exemptions, and other elements to determine the net payable tax amount.

They are highly beneficial as it helps to leverage advanced technology, highly experienced human resources, and expertise of third-party company for obtaining 100% accurate and flawless output.

You will benefit from outsourcing Tax Preparation services positively, as it will speed up your tax filing statement and report preparation. The outsourced Tax Preparers are committed to delivering premier-quality and flawless output within the dedicated timeframe.

They adhere to the deadlines and aim to provide you with assigned tasks in a rapid turnaround time. All their work complies with state tax laws, policies, and regulations.

They employ best practices, cutting-edge technology, and software to process complex tax returns, transactions, multiple accounts, and challenging investment entries with adroitness.

Note: The final timeline will vary depending on the amount of paperwork involved in Tax Report Preparation.

At GrandWorth Financial Consultancy, we believe that excellence is built on innovation, collaboration, and the continuous development of our people. As a global player in providing comprehensive financial services—including accounting, bookkeeping, auditing, tax planning, receivable and payable management, payroll processing, invoice management, and fractional CFO services—we empower our team to make an impact in the financial landscape.

When you join GrandWorth, you become part of a forward-thinking consultancy that values integrity, client-centric solutions, and teamwork. We offer opportunities to expand your skillset, engage in challenging projects, and collaborate with experts who are passionate about delivering the highest standards of service. Whether you’re an experienced professional or just beginning your career in the financial field, we invite you to contribute to our legacy of trust and excellence.

• Full time, Mid-Senior Level

• Location: Calicut, Kerala

• 2-4 years of experience in US income taxation experience

• Master’s degree or Enrolled Agent certification

At GrandWorth Financial Consultancy, we believe that excellence is built on innovation, collaboration, and the continuous development of our people. As a global player in providing comprehensive financial services—including accounting, bookkeeping, auditing, tax planning, receivable and payable management, payroll processing, invoice management, and fractional CFO services—we empower our team to make an impact in the financial landscape.

When you join GrandWorth, you become part of a forward-thinking consultancy that values integrity, client-centric solutions, and teamwork. We offer opportunities to expand your skillset, engage in challenging projects, and collaborate with experts who are passionate about delivering the highest standards of service. Whether you’re an experienced professional or just beginning your career in the financial field, we invite you to contribute to our legacy of trust and excellence.

• Full time, Mid-Junior Level

• Location: Calicut, Kerala

• 0-3 years of relevant resource management/workforce management / exposure in General Operations with strong acumen in resource management preferred.

• Bachelor’s degree in Human Resources, Business Administration, or related field.

At GrandWorth Financial Consultancy, we believe that excellence is built on innovation, collaboration, and the continuous development of our people. As a global player in providing comprehensive financial services—including accounting, bookkeeping, auditing, tax planning, receivable and payable management, payroll processing, invoice management, and fractional CFO services—we empower our team to make an impact in the financial landscape.

When you join GrandWorth, you become part of a forward-thinking consultancy that values integrity, client-centric solutions, and teamwork. We offer opportunities to expand your skillset, engage in challenging projects, and collaborate with experts who are passionate about delivering the highest standards of service. Whether you’re an experienced professional or just beginning your career in the financial field, we invite you to contribute to our legacy of trust and excellence.

• Full time, Junior Level

• Location: Calicut, Kerala

Assist in the recruitment process, including posting job openings, screening resumes, and scheduling interviews.

Support the onboarding process for new employees.

Help maintain and update employee records and documentation.

Assist in organizing employee engagement activities and events.

Provide support in payroll processing and compliance with labor regulations.

Help with general HR administrative tasks and projects.

Basic knowledge of HR practices and labor laws.

Strong communication and interpersonal skills.

Proficiency in MS Office; experience with HR software is a plus.

Willingness to learn and a proactive approach to tasks.

• Internship or up to 2 years of experience in HR roles preferred.

• Bachelor’s degree in Human Resources, Business Administration, or related field.

At GrandWorth Financial Consultancy, we believe that excellence is built on innovation, collaboration, and the continuous development of our people. As a global player in providing comprehensive financial services—including accounting, bookkeeping, auditing, tax planning, receivable and payable management, payroll processing, invoice management, and fractional CFO services—we empower our team to make an impact in the financial landscape.

When you join GrandWorth, you become part of a forward-thinking consultancy that values integrity, client-centric solutions, and teamwork. We offer opportunities to expand your skillset, engage in challenging projects, and collaborate with experts who are passionate about delivering the highest standards of service. Whether you’re an experienced professional or just beginning your career in the financial field, we invite you to contribute to our legacy of trust and excellence.

• Full time, Entry-level,

• Location: On Site

Assist with day-to-day accounting tasks, including data entry and ledger management.

Support in preparing financial statements and reports.

Perform reconciliations of bank statements.

Assist in maintaining accounts payable and receivable records.

Work closely with Clients and contribute to month-end closing processes.

Ensure compliance with company policies and accounting regulations.

Basic knowledge of accounting principles and practices.

Proficiency in MS Office (particularly Excel) and accounting software (e.g., Tally, QuickBooks, Zoho Books).

Strong analytical skills and attention to detail.

Good communication skills and a proactive approach to learning.

• Experience required (0-1 Year)

• ACCA/CMA/CA Dropouts or B.com Graduates

At GrandWorth Financial Consultancy, we believe that excellence is built on innovation, collaboration, and the continuous development of our people. As a global player in providing comprehensive financial services—including accounting, bookkeeping, auditing, tax planning, receivable and payable management, payroll processing, invoice management, and fractional CFO services—we empower our team to make an impact in the financial landscape.

When you join GrandWorth, you become part of a forward-thinking consultancy that values integrity, client-centric solutions, and teamwork. We offer opportunities to expand your skillset, engage in challenging projects, and collaborate with experts who are passionate about delivering the highest standards of service. Whether you’re an experienced professional or just beginning your career in the financial field, we invite you to contribute to our legacy of trust and excellence.

• Full time, Mid-senior level

• Location: Calicut, Kerala

An executive assistant coordinates and provides high-quality administrative support to the executive team. The role may include analyzing documents, preparing research reports, coordinating travel arrangements and occasionally supervising staff members.

• Schedule appointments, and maintain and update supervisors’ daily calendar

• Coordinate travel arrangements, prepare itineraries, plan logistics, and prepare presentations.

• Screen all incoming phone calls, inquiries, visitors, and correspondence, and route accordingly

• Maintain confidentiality of highly sensitive information.

• Manage complex office administrative work requiring the use of independent judgment and initiative

• Strong organizational skills and ability to prioritize multiple tasks seamlessly with a strong attention to detail

• Proficient in Microsoft Office (Outlook, Word, Excel, and Power Point), Adobe Acrobat, and social media web platforms.

• Strong interpersonal skills and the ability to build relationships with key stakeholders

• Experience required (1-3 yrs)

• Any graduate/MBA/Mcom

At GrandWorth Financial Consultancy, we believe that excellence is built on innovation, collaboration, and the continuous development of our people. As a global player in providing comprehensive financial services—including accounting, bookkeeping, auditing, tax planning, receivable and payable management, payroll processing, invoice management, and fractional CFO services—we empower our team to make an impact in the financial landscape.

When you join GrandWorth, you become part of a forward-thinking consultancy that values integrity, client-centric solutions, and teamwork. We offer opportunities to expand your skillset, engage in challenging projects, and collaborate with experts who are passionate about delivering the highest standards of service. Whether you’re an experienced professional or just beginning your career in the financial field, we invite you to contribute to our legacy of trust and excellence.

• Full time, Mid-senior level

• Location: Calicut, Kerala

Is responsible for overseeing and performing a wide range of bookkeeping tasks as well as Tax preparations. They will collaborate with clients, team members, and managers to provide high-quality bookkeeping & taxation services to maintain the financial integrity of the business.

• Utilize advanced knowledge of QuickBooks/Xero/Sage etc software to perform various bookkeeping tasks, including data entry, account reconciliation, and financial reporting.

• Accurately record financial transactions, including accounts payable, accounts receivable, payroll, and general ledger entries.

• Perform regular reconciliations of bank statements and financial accounts to ensure accuracy and identify any discrepancies.

• Process payroll, including calculating wages, deductions, and taxes, and ensure compliance with applicable laws and regulations.

• Prepare and generate financial reports, including profit and loss statements, balance sheets, and cash flow statements, using accounting software or spreadsheets.

• Assist in the month-end and year-end closing processes, including preparing adjusting entries, accruals, and reconciling accounts.

• Interact with clients to gather financial information, resolve queries, and provide regular updates on the status of their bookkeeping activities.

• Support the preparation and filing of various tax returns, such as sales tax, payroll tax, and income tax, in accordance with local, state, and federal regulations.

• Responsible for Preparation and review of US Personal, Business tax returns and tax projections.

• Deliver high-quality, accurate and timely work products.

• Keeping oneself updated with US/UK/ Canadian laws by participating in educational opportunities, reading professional publications, indulging in self-training.

• Perform research, propose solutions and be able to explain one’s findings pertaining to technical matters.

• Responsible for overall process performances and business requirements of clients daily.

• Self- manage multiple assigned clients and perform assignments within given time budgets and due dates.

• To have interpersonal and soft skills which are essential for drafting emails and being interactive with colleagues and managers

• Work closely with other team members, including associates and managers, to maintain open communication, share knowledge, and ensure consistent service delivery.

Must Have

• Knowledge of QuickBooks/Xero/Sage.

• US/UK/Canadian Tax preparation experience.

Good to have

• Team handling

• Qualified CA/CMA/ACCA with 0 to 3 years or MBA Finance, 5-7 years of experience in similar role.

• Strong accounting skills, effective communication, self-discipline, analytics and research abilities.

• Possess solid working knowledge of MS office and able to learn different software’s/applications.

• Interests in problem solving, logic, troubleshooting is very helpful.

• Responsible for team, allocating tasks and assessing team members work performance as per set parameters.

At GrandWorth Financial Consultancy, we believe that excellence is built on innovation, collaboration, and the continuous development of our people. As a global player in providing comprehensive financial services—including accounting, bookkeeping, auditing, tax planning, receivable and payable management, payroll processing, invoice management, and fractional CFO services—we empower our team to make an impact in the financial landscape.

When you join GrandWorth, you become part of a forward-thinking consultancy that values integrity, client-centric solutions, and teamwork. We offer opportunities to expand your skillset, engage in challenging projects, and collaborate with experts who are passionate about delivering the highest standards of service. Whether you’re an experienced professional or just beginning your career in the financial field, we invite you to contribute to our legacy of trust and excellence.

• Full time, Mid -Junior Level

• Location: Calicut, Kerala

Is responsible for overseeing and performing a wide range of bookkeeping tasks as well as Tax preparations. They will collaborate with clients, team members, and managers to provide high-quality bookkeeping & taxation services to maintain the financial integrity of the business.

• Manage accounting operations including accounts receivable, accounts payable, general ledger entries, and bank reconciliations

• Ensure accurate recording and categorization of financial transactions, such as sales, purchases, expenses, and journal entries.

• Perform month-end and year-end closing procedures, including reconciling accounts, preparing adjusting entries, and assisting in financial statement preparation.

• Prepare and analyze financial statements, including profit and loss statements, balance sheets, and cash flow statements, on a regular basis.

• Stay updated on changes in accounting standards, tax regulations, and industry best practices to ensure compliance and recommend process improvements.

• Interact with clients to gather financial information, resolve queries, and provide regular updates on the status of their bookkeeping activities.

• To have interpersonal and soft skills which are essential for drafting emails and being interactive with colleagues, managers and clients.

• Proficiency in MS Excel and other accounting tools.

• Minimum of 2 – 3 years’ experience with using QuickBooks, Zoho Books, Wave, Xero etc.

• Bachelor’s degree in accounting, finance, or a related field.

• Proven experience working with industry specific accounting software.

• Excellent attention to detail and accuracy in data entry and financial analysis.

• Strong analytical and problem-solving skills.

• Ability to work independently and manage multiple tasks and deadlines effectively.

• Good communication and interpersonal skills to collaborate with cross-functional teams.

At GrandWorth Financial Consultancy, we believe that excellence is built on innovation, collaboration, and the continuous development of our people. As a global player in providing comprehensive financial services—including accounting, bookkeeping, auditing, tax planning, receivable and payable management, payroll processing, invoice management, and fractional CFO services—we empower our team to make an impact in the financial landscape.

When you join GrandWorth, you become part of a forward-thinking consultancy that values integrity, client-centric solutions, and teamwork. We offer opportunities to expand your skillset, engage in challenging projects, and collaborate with experts who are passionate about delivering the highest standards of service. Whether you’re an experienced professional or just beginning your career in the financial field, we invite you to contribute to our legacy of trust and excellence.

• Full time, Junior Level

• Location: Calicut

We are in the lookout for a talented Content Writer to create compelling blog posts, white papers, product descriptions, social media content and web copy. We’re looking for someone who can expand our digital footprint and drive more value through online content. You should have had a proven track record of producing pieces that increase engagement and drive leads. This role requires high level of creativity, as well as the ability to use data-driven insights to write better material.

• Creating concise, eye-catching, and innovative headlines and body copy

• Researching and organizing facts and sources

• Consistently brainstorming and collaborating with team for new ideas and strategies

• Building a following for brand on social media with creative work

• Researching markets and industries to compare and create content that is innovative and original

• Collaborating with campaign managers, creative team, and designers

• Writing a wide variety of topics for multiple platforms (website, blogs, articles, social updates, banners, case studies, guides, white papers, etc.)

• Be willing to answer any questions posted by their readers.

• Create content on e-books, podcasts etc.

• Promote content on social media

• Identify customers’ needs and gaps in our content and recommend new topics

• Ensure all-around consistency (style, fonts, images and tone)

• Update website content as needed

• Edit content produced by other members of the team

• Analyse content marketing metrics and makes changes as needed

• Collaborate with other departments to create innovative content idea

• Proven work experience as a Content Writer, copywriter or similar role

• Portfolio of published articles

• Experience doing research using multiple sources

• Familiarity with web publications

• Excellent writing and editing skills in English

• Hands-on experience with Content Management Systems (e.g. WordPress)

• Ability to meet deadlines

• Knowledge of digital marketing tactics, including SEO, email marketing and web analytics

• Bachelors/Masters in English, Journalism, Marketing or related field

At GrandWorth Financial Consultancy, we believe that excellence is built on innovation, collaboration, and the continuous development of our people. As a global player in providing comprehensive financial services—including accounting, bookkeeping, auditing, tax planning, receivable and payable management, payroll processing, invoice management, and fractional CFO services—we empower our team to make an impact in the financial landscape.

When you join GrandWorth, you become part of a forward-thinking consultancy that values integrity, client-centric solutions, and teamwork. We offer opportunities to expand your skillset, engage in challenging projects, and collaborate with experts who are passionate about delivering the highest standards of service. Whether you’re an experienced professional or just beginning your career in the financial field, we invite you to contribute to our legacy of trust and excellence.

• Full time, Junior Level

• Location: Remote job oppurtunity

Is responsible for overseeing and performing a wide range of bookkeeping tasks as well as Tax preparations. They will collaborate with clients, team members, and managers to provide high-quality bookkeeping & taxation services to maintain the financial integrity of the business.

• Manage accounting operations including accounts receivable, accounts payable, general ledger entries, and bank reconciliations.

• Ensure accurate recording and categorization of financial transactions, such as sales, purchases, expenses, and journal entries.

• Interact with clients to gather financial information, resolve queries, and provide regular updates on the status of their bookkeeping activities

• To have interpersonal and soft skills which are essential for drafting emails and being interactive with colleagues, managers, and clients

• Proficiency in MS Excel and other accounting tools.

• Minimum of 0 – 1 year experience with using QuickBooks, Zoho Books, Wave, Xero etc.

• Qualified Bachelor’s degree in accounting, finance, or a related field.

• Good communication and interpersonal skills to collaborate with cross-functional teams.